This is a wonderful story that I just have to report on, in case you've missed it; today billionaire hedge funds suffered huge losses at the hand of regular investors in a loosely coordinated attack in defense of Gamestop. This is a unique instance of we the people playing the billionaires in the stock market and winning big!

source: YouTube

What happened? What has billionaire traders freaking out? Well, it's all about an attempted short-squeeze of Gamestop by these billionaire hedge funds that went horribly wrong. So it all starts with the Gamestop brick and mortar video game stores. This is important to note, that it was your old-fashioned brick and mortar chain of stores that never upgraded to becoming an online store, when all the money is being made by online retailers. Especially since April last year, when the effects of the pandemic were really becoming apparent, the company has been struggling while trying to sort out its future; it turns out people don’t like walking into stores, especially during a pandemic, to buy games they could just download from home. And when the pandemic really hit home, Gamestop announced it would close 300 locations permanently; on April 1st Gamestop's stock price was $3.25, and it has been hovering around the 3 - 4 dollar mark most of 2020.

Then, in August, well-known investor Ryan Cohen bought a 13 percent stake in the company and the following month wrote a harsh letter to its board and specifically its CEO, in which he blamed them for squandering billions of dollars by not keeping up with the transition from traditional hardware to digital streaming and downloads. That generated a lot of press already, which was overshadowed when Ryan Cohen went on to serve on Gamestop's newly expanded board. That event triggered a lot of retail investors, that's normal people like you and I dear reader, people without an extensive background in finances or stock market trading. Believing that Cohen would rebuild the company they invested a lot of their hard earned dollars into its stock, causing a 50% rise in its price just two days after Cohen joined Gamestop's board; the price went up from around 20 dollar to over 30 dollar after shortly peaking at $38.65.

And this is where the story gets interesting. Seeing this sudden surge of 50% in two days, institutional investors, including some well-known hedge funds, took out massive short positions against the stock. In case you don't know, taking on a short is like making a bet that the stock will fail, which means that these billionaire investors would make a lot of money if Gamestop's stock price would go down. The price going down also would imply that all those retail investors would lose their hard earned dollars, and furthermore, because these professional Wall Street traders trade with a lot of leverage, they would be able to reduce the stock's price to nearly zero. It's like a self-fulfilling prophecy; when the big players see one or two well-known and well-respected (in their circles) investors short a stock, many will follow driving the price down, and making the billionaires even richer while bankrupting Gamestop and making most of its employees jobless. You see, for these rich institutional traders the stores and the people who work there mean exactly nothing; they couldn't care less of a bunch of flesh and blood human beings lose their livelihood, it's just numbers to them and they sleep well as long as they make money.

How Reddit Is Tanking Wall Street Hedge Funds

Short intermezzo, literally; this is what happened during the crisis of 2007 / 2008 as well. If you remember, a bunch of investment banks bundled sub-prime mortgages and colluded with rating agencies to have them rated way above their actual value. They then sold these worthless bundles to unsuspecting buyers who saw them as triple A products, because that's how they were rated. These investment bankers sold the bundles with a label that fooled their buyers into thinking that their value would go up, while they knew it was mainly sub-prime mortgages inside, bound to fail. And then they shorted them to make money twice; once with the sale and once when they failed. Back then they didn't care for the millions who lost their homes, and now they don't care about Gamestop, the retail investors who set their hopes on its recovery or its employees.

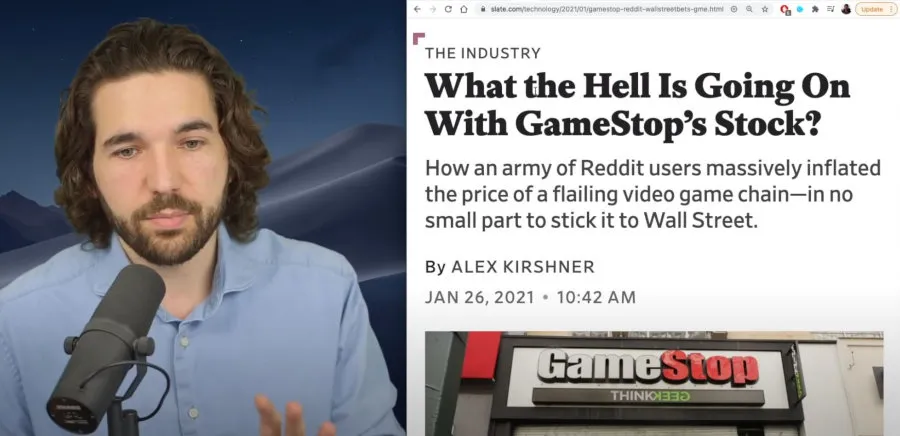

Enter r/WallStreetBets; the Reddit Wall Street speculation community with more than 2 million members. They saw what the institutional investors were planning for Gamestop and made a plan to stop them. From the January 26th Slate article about this beautiful uprising against Wall Street:

In September, an enterprising subredditor had posted a seven-point treatise titled “Bankrupting Institutional Investors for Dummies, ft GameStop.” The subredditor noted the stock already had a significant short exposure (months before Cohen joined the board) and predicted that short sellers would be forced to abandon their positions and, in buying back their stocks, drive the price up. R/WallStreetBets users delighted in the idea and took it as a chance to egg one another on.

Hype around GME continued bubbling up around r/WallStreetBets over the ensuing weeks, from posters who apparently saw it all along as a profit opportunity. The stock’s boom has made some of them big money. The most famous is a user calling themselves “DeepFuckingValue” who had apparently turned a six-figure investment into nearly $14 million by this Monday.

Others may have just wanted to screw short sellers, who are by definition rooting for shareholders and companies to suffer. They’re also often considered to be sophisticated investors, cast against the determined amateurs populating internet forums. At the end of November, the subreddit ascertained that hedge fund Melvin Capital Management was shorting GameStop, and the community rallied with fury against the New York–based fund.

source: Slate

If you're into cryptocurrencies a lot of this must ring a bell; much of the narrative has always been around our constant struggle with "whales" manipulating prices and stamping down on the "little man". Even here on our favorite blockchain-based platforms, Steemit, Hive, Trybe and more, we regularly lament the concentration of power in the hands of those who hold large amounts of their associated crypto-currencies. This has always been the David and Goliath of our lives, the 1% versus the rest of us, and it's so nice to just for once see the rest of us win! :-) On the flip-side, bitcoin has suffered a massive dump today, and some voices speak of a connection between the Gamestop story and this sudden downturn in bitcoin's price. I for one don't care; bitcoin's fundamentals haven't changed and if you're in this space for as long as I have, 30%, 40%, even 50% or 80% drops are nothing new. There's no problem if you believe in the underlying fundamentals and in it for the long term. So please watch the enclosed videos and read the Slate article for further entertainment...

Breakdown: Billionaire Traders LOSE BIG After Reddit Community Screws Them With GameStop

Thanks so much for visiting my blog and reading my posts dear reader, I appreciate that a lot :-) If you like my content, please consider leaving a comment, upvote or resteem. I'll be back here tomorrow and sincerely hope you'll join me. Until then, keep safe, keep healthy!

Recent articles you might be interested in:

| Latest article >>>>>>>>>>> | Bare Minimum |

|---|---|

| It's Happening Right Now... | To The Right Y'all |

| Through Your Eyes | Extraordinary Claims |

| Already Breaking Promises | Trump's 12 Accomplishments |

Thanks for stopping by and reading. If you really liked this content, if you disagree (or if you do agree), please leave a comment. Of course, upvotes, follows, resteems are all greatly appreciated, but nothing brings me and you more growth than sharing our ideas.