SOURCE

When it comes to protecting your portfolio and hedging against inflation, few assets have a track record as impressive as silver. Often referred to as "golds baby brother," silver has stood the test of time as a reliable investment option, regardless of the year or decade. Diversifying your portfolio with 1 oz silver bars can be a strategic move, thanks to their low correlation to stocks and bonds. While experts may have varying opinions on the ideal silver allocation, a general guideline suggests investing around 10 to 15% of your portfolio in metals overall is a good start. I personally have a higher allocation, as I honestly believe that precious metals have, are and will always be the true and only form of "real" money.

Silver's value has experienced significant fluctuations over the years, driven by various global factors. During the global financial crisis and amidst geopolitical instability in the US, concerns about the Federal Reserve's monetary easing strategy sent silver prices soaring to nearly $64 per ounce in 2011. However, the onset of the pandemic led to a sharp decline, with silver's price falling below $12 by 2020. As hopes for a global economic recovery emerged in early 2021, the price of silver rebounded and reached around $30.

SOURCE

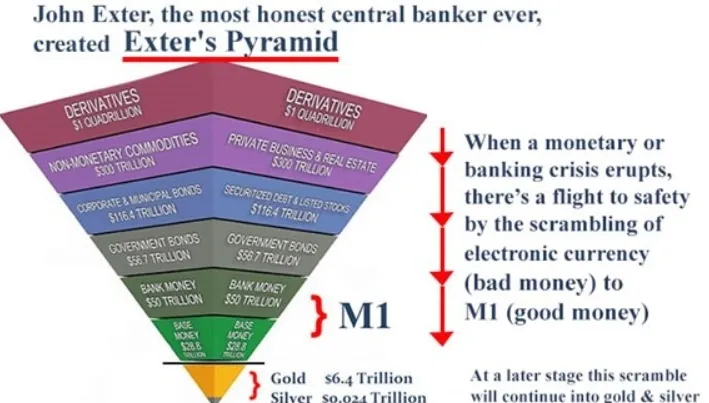

Not to sound like the continual broken record that i am, playing the same tune over and over again, but investing in 1 oz silver bars holds immense potential due to the consistent upward trajectory of silver's value over time. During challenging economic situations that have plagued large organisations and multinational corporations, silver has proven to be a valuable and trusted asset, earning the confidence of both seasoned investors and newcomers alike. Exeter's Pyramid (above) serves as a compelling symbol of how money tends to flow towards precious metals during times of crisis. Just as the pyramid stands tall and sturdy, precious metals like gold and silver often become sought-after safe-haven assets during economic uncertainty. Embracing silver as an investment option can be a wise decision, offering stability and growth opportunities for your financial goals.

SOURCE

Silver has gained popularity among investors, particularly due to its price differential with gold. The silver-gold ratio, which measures the price difference between the two metals, currently sits at around 85, making silver a more accessible choice for many. The affordability factor, combined with the upward trend in silver's value, makes it an attractive entry point for individuals venturing into the world of precious metals.

SOURCE

When it comes to the actual purchasing of silver, opting for 1 oz silver bars presents several advantages over smaller silver coins. Notably, the lower price per ounce of silver bars makes them an appealing choice. With silver's relatively modest price, you can acquire substantial amounts of silver at reasonable prices. Additionally, the production costs for silver bars are comparatively lower, resulting in more affordability. Investing in silver bars allows you to maximise the value for your investment, as you can obtain a greater quantity of silver for your money. Moreover, given the projected increase in industrial demand, the silver market is expected to rise in the future, providing an opportunity for significant returns. By purchasing 1 oz silver bars now, you can secure an advantageous price and potentially reap substantial profits in the long run.

SOURCE

Silver continues to be a reliable and rewarding investment option. Its historical performance as an inflation hedge, combined with the current market conditions and favourable price differentials, makes it an appealing choice for diversifying your portfolio. Whether you are a seasoned investor or just starting your journey, exploring the potential of 1 oz silver bars can prove to be a smart move. Seize the opportunity to unlock the hidden potential of silver and embark on a path towards financial growth. Trust me, youll thank me in a few year!!

If you dont own any precious metals, then why not tell us? As a community we encourage ALL engagements and encourage everyone to take the plunge and own at lease a sinlge ounce of silver or a fraction of gold. If your struggleing to find a safe and secure place to buy, reach out to the community as there is always someone willing to offer their time and advice to help you out.

40+yr old, trying to shift a few pounds and sharing his efforsts on the blockchain. Come find me on STRAVA or actifit, and we can keep each other motivated .

Proud member of #teamuk. Teamuk is a tag for all UK residents, ex-pats or anyone currently staying here to use and get a daily upvote from the community. While the community actively encourages users of the platform to post and use the tag, remember that it is for UK members only.

Come join the community over on the discord channel- HERE

Want to find out more about gold and silver? Get the latest news, guides and information by following the best community on the blockchain - #silvergoldstackers. We're a group of like minded precious metal stackers that love to chat, share ideas and spread the word about the benefits of "stacking". Please feel free to leave a comment below or join us in the community page, or on discord.